History of Credit Card Fees in Canada and Around the World

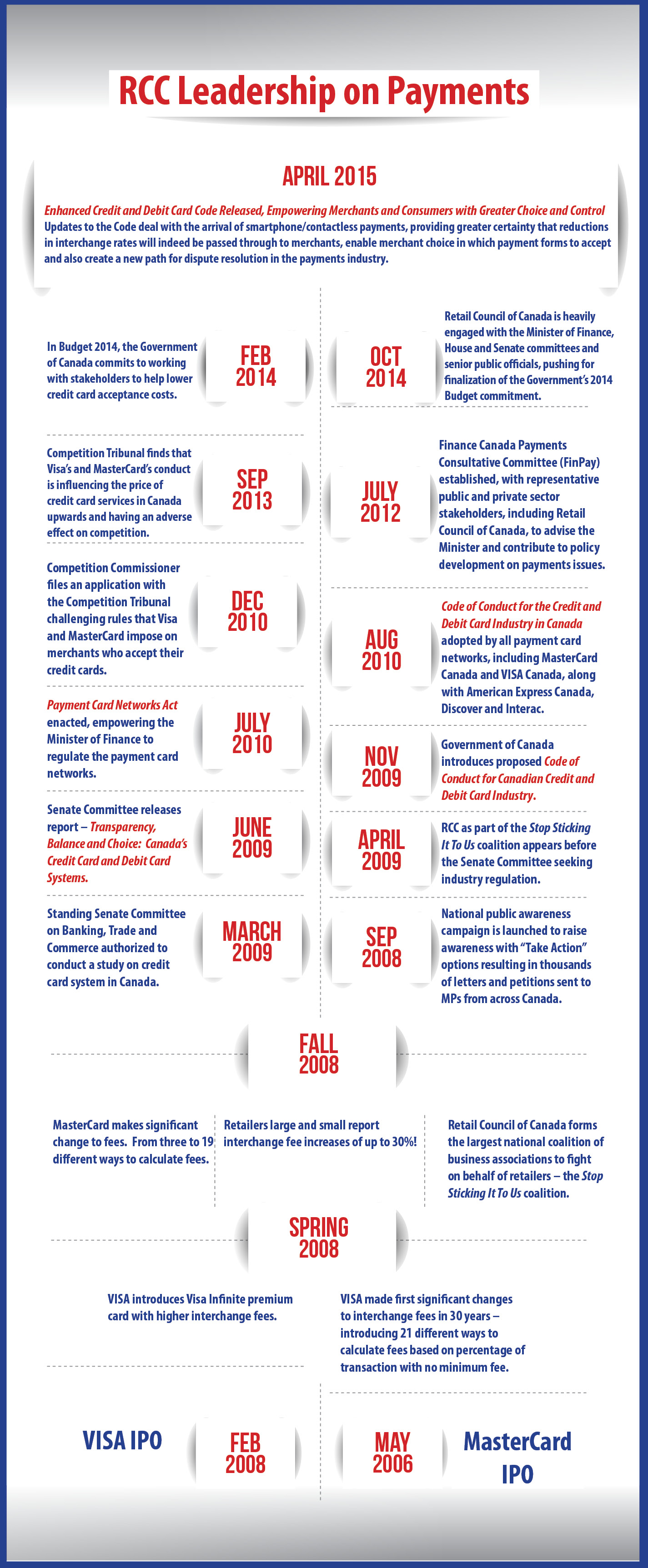

October 11, 2014There’s no question that credit cards are playing an increasingly important role in how Canadians purchase goods and services. Premium credit cards now make up 30 percent of the value of all credit card transactions and RCC merchants attribute most of the increase in credit card costs to the use of premium, and now super-premium cards. The following time-line outlines the major milestones in the recent history of credit cards in Canada.

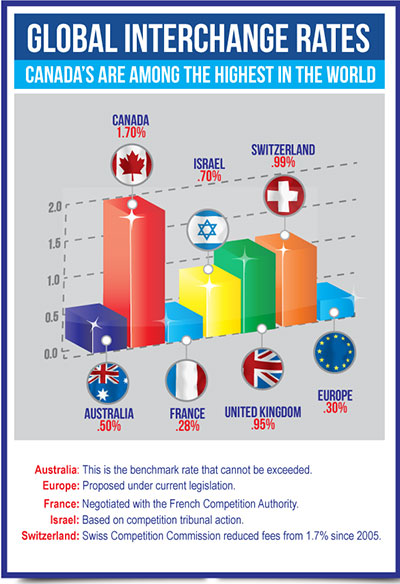

Many countries around the world have taken steps to introduce regulation or negotiated agreements to cap and lower interchange. For example, France limits interchange rates to 0.28% on credit. Australia limits interchange to an average of 0.50%. By comparison, interchange rates in Canada average 1.7%, and range from 121 basis points to as high as 265 basis points.