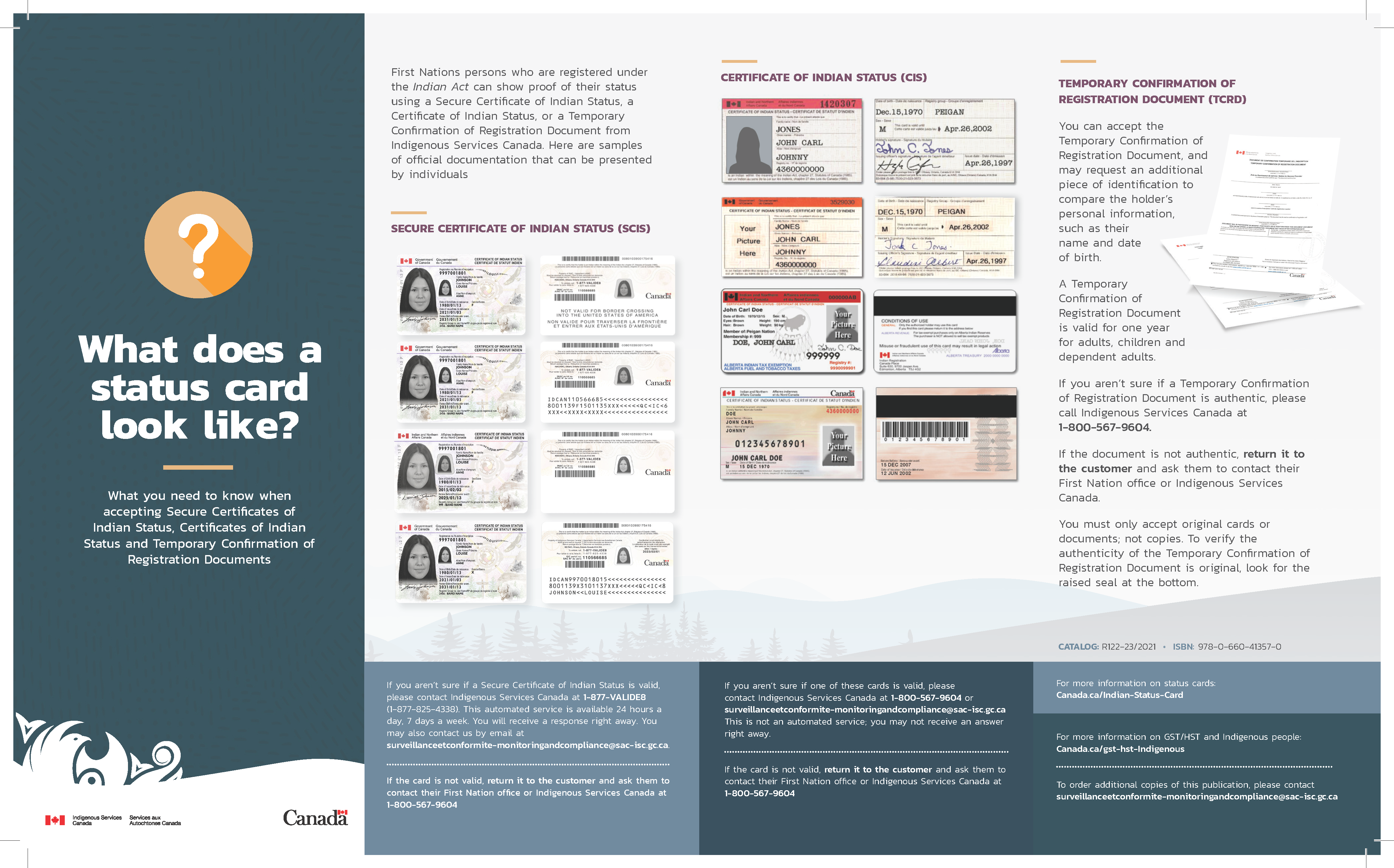

The Department of Indigenous Services Canada (“ISC”) has generated a helpful information flyer regarding The Secure Certificate of Indian Status (or secure status card, SCIS) and the Certificate of Indian Status (or status card, CIS – laminated) which are issued to confirm registration under the Indian Act and can be used for identification purposes. These can also be used for the purposes of claiming sales tax exemptions, whether for the Goods and Services Tax (GST), Quebec Sales Tax (QST), Harmonized Sales Tax (HST) or for the provincial retail sales taxes in Manitoba, Saskatchewan and British Columbia.

The ISC flyer will help eliminate confusion over the types of status cards (what they are, what to look for, and which cards are acceptable and in circulation). ISC is also offering an automated 24/7 verification line to validate the Secure Certificate of Indian Status (SCIS): 1-877-VALIDE8 (1-877-825-4338).

For the Certificate of Indian Status (laminated CIS card) there is a new toll free number that is available for CIS during business hours of 9am to 6pm EST to validate the card if needed. The number is 1-800-567-9604 “verification of laminated status card” (option #6) and an email address for inquiries, validations and to order flyers for your company: surveillanceetconformite-monitoringandcompliance@sac-isc.gc.ca.

What the ISC info sheet does not do is speak to the circumstances in which a sales tax exemption may be claimed. The basic rules are outlined below but in a nutshell, only Ontario permits a point-of-sale exemption (for its 8% portion of the HST), whereas in every other province and territory, a sales tax exemption can only be claimed where goods are to be delivered to the reserve by vendors or their agents (e.g., a courier or the postal service). The Canada Revenue Agency has a helpful page at GST/HST and First Nations peoples – Canada.ca.

More generally, the rules are as follows:

| Region | Basic Guideline |

|---|---|

| Federal | Status Indians may claim an exemption from paying the five per cent Goods and Services Tax (GST) when the goods are delivered to the reserve by vendors or their agents (e.g., a common carrier or the postal service). This rule applies Canada-wide. |

| Newfoundland & Labrador, New Brunswick, Nova Scotia, Prince Edward Island | Status Indians may claim an exemption from paying the fifteen per cent Harmonized Sales Tax (HST) when the goods are delivered to the reserve by vendors or their agents (e.g., a common carrier or the postal service). |

| Quebec | Status Indians may claim an exemption from paying the five per cent Goods and Services Tax (GST) and from the 9.975 per cent Quebec Sales Tax (QST) when the goods are delivered to the reserve by vendors or their agents (e.g., a common carrier or the postal service). |

| Ontario | Status Indians may claim an exemption from paying the eight per cent Ontario component of the Harmonized Sales Tax (HST) on goods or services at the point of sale. A Certificate of Indian Status card or Temporary Confirmation of Registration document is requires in order to claim this point of sale exemption. Exemption from the full thirteen per cent Harmonized Sales Tax (HST (including the 5% GST) only applies when the goods are delivered to the reserve by vendors or their agents (e.g., a common carrier or the postal service). |

| Nunavut, Northwest Territories | Status Indians may claim an exemption from paying the five per cent Goods and Services Tax (GST) when the goods are delivered to the reserve by vendors or their agents (e.g., a common carrier or the postal service). |

| Manitoba | Status Indians may claim an exemption from paying the five per cent Goods and Services Tax (GST) and from the five per cent Manitoba Retail Sales Tax (RST) when the goods are delivered to the reserve by vendors or their agents (e.g., a common carrier or the postal service). |

| Saskatchewan | Status Indians may claim an exemption from paying the five per cent Goods and Services Tax (GST) and from the six per cent Saskatchewan Provincial Sales Tax (PST) when the goods are delivered to the reserve by vendors or their agents (e.g., a common carrier or the postal service). |

| Alberta | Status Indians may claim an exemption from paying the five per cent Goods and Services Tax (GST) when the goods are delivered to the reserve by vendors or their agents (e.g., a common carrier or the postal service). Alberta does not have a provincial sales tax. |

| British Columbia | Status Indians may claim an exemption from paying the five per cent Goods and Services Tax (GST) and from the seven per cent British Columbia Provincial Sales Tax (PST) when the goods are delivered to the reserve by vendors or their agents (e.g., a common carrier or the postal service). |