As more Canadians opt for credit card payment, whether chip-and-PIN, contactless, or online, Canada must lower its interchange fees to align with other international jurisdictions to support businesses in Canada.

The issue with payment and credit card fees in Canada

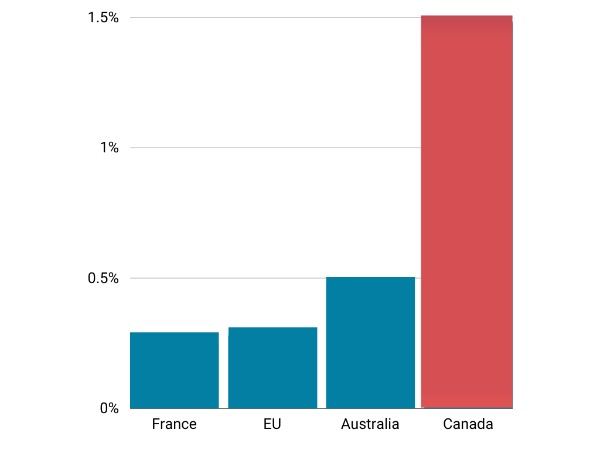

Canadians pay some of the highest interchange (a.k.a. ‘swipe fees’) in the world. Close to 1.5% of Canadian credit card spending goes directly to the big credit card companies and their issuing banks, therefore reducing retailers’ profit margins and driving up prices for Canadian consumers. Lowering these fees will make doing business in Canada more affordable and will save Canadians money on their everyday purchases.

It should come as no surprise that shopping online, which was already on the rise, dramatically spiked at the peak of the pandemic. Even as brick-and-mortar stores slowly reopen, online shopping and touchless payment is only expected to grow significantly from where it stood pre-pandemic. Consequently, this increase in credit card use has increased payment costs for retailers and consumers.

RCC’s fight to reduce fees

RCC has long fought for lower credit card interchange rates, securing a victory in 2015 with a reduction of the average rate from 1.65% down to 1.50%. Further success has been achieved with a commitment from Visa and MasterCard to lower their average rates from 1.50% to 1.40% in 2020. Altogether, the reduction efforts achieved by RCC save merchants over $1 billion annually.

Worldwide, 37 countries have recognized the uncompetitive level of interchange fees and have moved to reduce and cap them. For example, France limits interchange to 0.28%, the EU is moved to a 0.30% cap across the board, Australia limits interchange to an average of 0.50%. Canada needs to follow suit.

What is RCC doing now to help reduce the cost of payments?

RCC is encouraging the Minister of Finance to:

- Implement the budget commitment to help lower credit card acceptance fees; and

- Broaden the Code of Conduct to ensure mobile payments do not result in further cost increases to Canadian merchants and their consumers. In particular Code must dictate that online and mobile transactions are treated as a “card present” not higher cost “card not present option” which adds cost to merchant.

Payments 101

Have you ever wondered what happens when a customer makes a purchase using various forms of payment? What’s the difference between using cash, debit and credit?

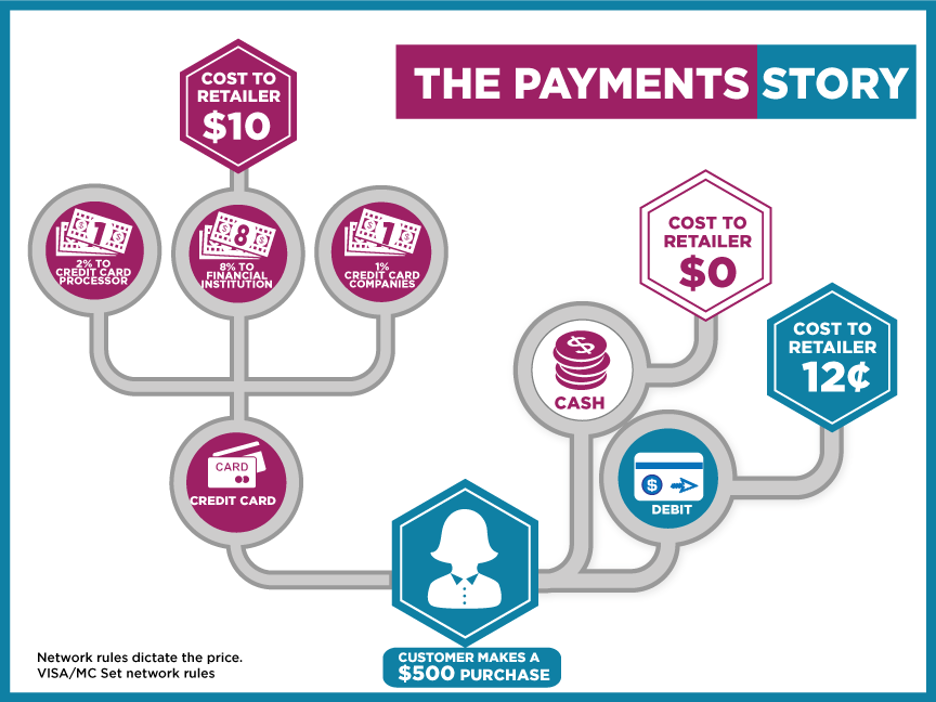

Credit Card

Merchants pay a merchant discount rate on each credit card transaction. This rate is a combined rate that is distributed a number of ways: the majority (80%+) goes to the cardholder’s bank as an interchange fee. The remainder is split between the networks (e.g. VISA or MasterCard), and the processor (e.g. Chase).

The Network – VISA or MasterCard dictate the price. They set the rules for how much Interchange is charged.

The graphic above illustrates a $500 transaction:

- Approximately $2 of the Merchant Discount Rate goes to the Network and Processor

- Approximately $8 goes to the Financial Institution

- What about Rewards – who pays for those? Of the $8 that goes to the Financial Institution:

- Approximately $6 remains with the Bank

- Approximately $2 is used to fund the Rewards Programs

- The merchant discount rate is a percentage of the purchase price – the more expensive the item, the higher the fee.

- Different kinds of credit cards are charged different rates. For example a basic, no rewards card may have a Merchant Discount Rate of as low as 1.6%. A premium card, offering expensive rewards, may cost as much as 3%.

Debit

Debit transactions are charged a single transaction rate – regardless of the value of the purchase. It generally costs merchants under 10 cents to process each debit transaction, though the fee can be as high as 40 cents. This amount does not change, whether the purchase is for $5 or $5,000.

Cash

When a customer pays cash for an item, the cost is virtually $0 to the merchant.

The Cost to the Retailer

For a $500 transaction – the cost to the retailer can then range from:

- Cash: $0

- Debit: $0.10

- Credit: $10

The more people who use credit cards – the more expensive the cost to retailers and the higher prices become for everyone.

Tools and resources

Discount payment processing through Chase

RCC has secured a partnership with Chase to offer members discounts on card payment fees.