Recent Updates

- CBSA Assessment and Revenue Management (CARM) Launches Oct 21Canada Border Services Agency’s (CBSA) new online portal – CBSA Assessment and Revenue Management (CARM) – will come … Continued

- CBSA Slams Breaks on CARM Amid Retailers’ Relief Attention retailers who import goods into Canada: The Canada Border Services Agency’s (CBSA) CBSA Assessment and … Continued

- Vancouver cup fee to be repealedVancouver’s City Council has decided to repeal the controversial single-use cup fee at some point … Continued

The importance of retail in Canada’s economy

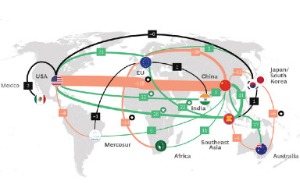

The products that retailers sell are subject to a range of trade agreements, policies and regulations that have an impact on product availability and price. RCC advocates for agreements and requirements that are clear and fair for both retailers and consumers.

As the largest private-sector employer in the country, retailers in Canada hold a critical role in our economy. It is imperative our government support retailers by providing the necessary conditions required to remain competitive and evolve in a highly changeable landscape.

Advocating for retailers

We’ve got your back: Advocating for retailers on international trade agreements

RCC advocates for fair and accessible trade agreements that enhance access and affordability for Canadian consumers.

At the Standing Committee on International Trade on Feb 24, 2020, on Bill C-4, RCC’s Vice President Grocery Division and Regulatory Affairs in Ottawa, Jason McLinton, spoke passionately on behalf of all retailers in Canada advocating for the swift ratification of the Canada – United States – Mexico Agreement (CUSMA) to maximize competitive prices at retail and consumer choice. RCC advocated on the following needs for retailers:

- Maintain the new De Minimis threshold as negotiated

- Establish a visitor rebate program administered by retailers

- Ensure that grocery retailers are given their fair share of the new tariff quotas for supply managed goods

Progress made on easing interprovincial trade regulations

Eliminating interprovincial trade barriers that impact retail business in Canada has been and remains a major RCC member priority and RCC has continually pushed for advancement in several key areas. These include a harmonized approach to labelling upholstered and stuffed articles, a national standard for occupational health and safety requirements, harmonized environmental stewardship programs, and various transportation requirements, to name a few.

RCC wins in this area:

- Both Ontario and Manitoba have agreed to revoke their Upholstered and Stuffed Articles Regulations and Québec has agreed to undertake a comparative review of their measures to determine if material differences exist. These are duplicative labelling requirements of current federal legislation and regulations (the Canada Consumer Product Safety Act and the Toys Regulation under that Act; and the Textile Labelling and Advertising Regulations under the Textile Labelling Act) and are an unnecessary burden on business.

- Some jurisdictions have signed a reconciliation agreement that requires them to make regulatory or legislative changes. These changes include occupational health and safety standards for first-aid kits, head protection, eye and face protection, hearing protection, foot protection, and personal flotation devices and life jackets. This agreement will simplify regulatory requirements for organizations, allowing them to work more seamlessly across multiple jurisdictions without compromising health and safety protections for workers.

RCC will continue to push for greater trade within Canada including harmonization of workplace first aid training, transportation issues, and food/meat inspection requirements.

Eliminate tariffs on clothing and textiles

Canadians are paying around $5 billion in hidden taxes (or up to 10% extra) each year because of tariffs, increasing living costs unnecessarily. This means that when Canadians purchase a $150 pair of shoes, they’re often paying $16 more than if there wasn’t a tariff.

Historically, tariffs were used as a method for protecting our domestic industries from out-of-country competition. However, today only 4.4% of textile and clothing products used by Canadians are manufactured domestically. Since these tariffs are remnants of an outdated system that was designed to protect an industry that has moved offshore, they now act only as a hidden tax to consumers.

RCC is asking the government to:

- Eliminate tariffs on clothing and shoes to make life more affordable for Canadian families.

- Undertake a review of tariffs to understand what is still needed to protect Canadian businesses and what is now only a legacy system.

Reducing food and beverage costs

Access to tariff rate quotas under Canada’s Free Trade Agreement

RCC advocates for retailers to have their fair share of access to quotas for food products subject to Canada’s international free trade agreements. RCC submitted comments on the Review of the Allocation and Administration of Tariff Rate Quotas, advocating for retailers to be treated fairly in accessing import quotas, which helps keep prices low for consumers.

Dairy pricing

RCC works through the Canadian Dairy Commission, with stakeholders from across the value chain in support of affordable dairy princes for consumers. Additionally, RCC participates in the consultations concerning the fixing of the price of retail milk in Quebec at the Régie des marchés agricole et alimentaire du Québec, to ensure reasonable increases and the respect for the deadlines necessary for members to make the required adjustments.

Marketing agencies & levies

Some food and beverage products in Canada are subjected to levies that support marketing agencies. RCC works with the Farm Products Council of Canada to ensure that while Canadian products are promoted, they remain affordable for Canadian consumers.

Tools and resources

Redrawing the Map of Global Trade – BCG insights

Global trade in 2020 is projected to decline by 20% and it is not projected to regain its 2019 absolute level of $18 trillion until 2023.

Regardless of when the top-line numbers fully recover, however, the global trade landscape will still look dramatically different as companies shift their focus from fighting the pandemic to winning the post-COVID-19 future.

RCC’s retail economic recovery plan 2021

As we all work through the long-term impacts brought on by COVID-19, the key retail measures RCC outlined in RCC’s submission will help ensure the recovery of Canada’s retail industry, boosting Canada’s economic growth and making life more affordable for Canadian families.

Introduce a new Visitor Rebate Program in Canada and help rebuild our tourism market

Introducing a new Visitor Rebate Program in Canada would be a much-needed boost for retailers and other industries who’ve been devastated by the pandemic in the long run.

Contact Matt Poirier, Vice President, Government Relations at mpoirier@retailcouncil.org for more information on:

- Joining RCC’s exclusive members-only committees.

- Information on federal and grocery issues related to retailers.