Retail and the robotics revolution

September 17, 2017

How machine automation is transforming operational efficiencies and the way retailers look at the business.

BY RANDY SCOTLAND

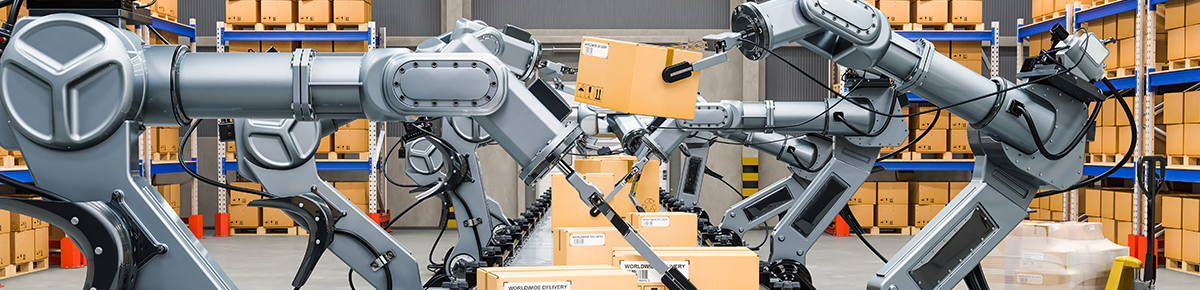

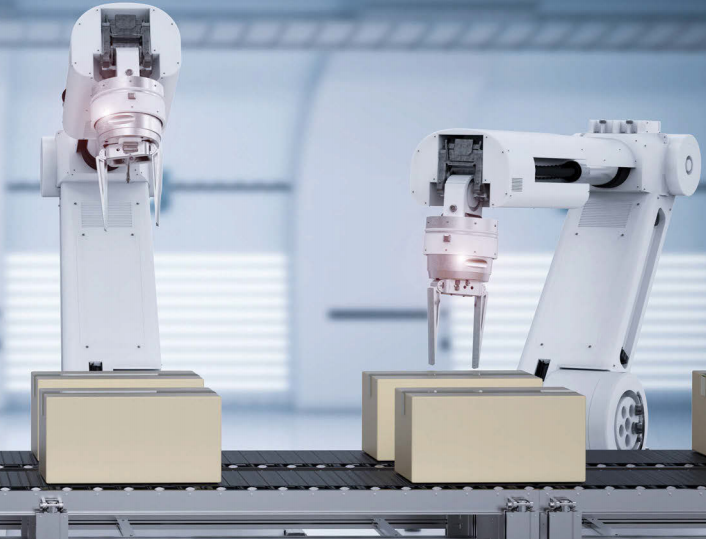

ONCE the stuff of science fiction, the growing prevalence of robotics in the workplace is having a transformative impact on the retail industry, where big investments in automation is revolutionizing the way goods are being warehoused, picked, packed and distributed.

Retailers looking to cut backend costs and boost operational efficiencies are building or retrofitting facilities that incorporate the latest in robotic machinery. The price tag to do so doesn’t come cheap—running into the tens of millions of dollars per facility, depending on the scope of the project. But the potential payoff is equally significant.

“When you look at the dramatic decrease in space that is possible once you eliminate the need for manually driven forklifts and the need for people to navigate aisles, once these robotics systems go in you can experience up to a 40 per cent decrease in the warehouse size itself, and up to an 80 per cent decrease in the manpower that’s required to actually make that warehouse work,” says consultant and retail industry futurist Doug Stephens, Founder and President of Retail Prophet.

“This is no less impactful than the movement of robots into the auto industry in the 1970s and ’80s,” he adds. “It will have as dramatic an effect. The cost savings are just as massive. And in a retail market where retailers find that top-line growth is elusive, the backend potential for savings is extraordinary.”

HBC’s state of the art

Hudson’s Bay Company’s 752,000 square-foot distribution centre in Scarborough, ON, which the company said cost in excess of $60 million to upgrade, is a case in point. Opened late last year, it has a stateof-the-art robotic fulfilment system incorporating a Perfect Pick case shuttle method that is said to be 12 to 15 times faster than a manual process.

According to HBC, the facility can hold more than one million units of inventory and can process roughly 4,200 customer orders an hour. Two custom-built document handling robots automate insertion of packing lists, while 15,000 feet of conveyor and a fleet of some 300 autonomous vehicles move inventory for storing and shipping.

“Our customers will benefit from the country’s fastest order shipping system,” announced Jerry Storch, HBC’s Chief Executive Officer. “This investment in our Scarborough distribution centre creates an e-commerce technology hub and allows us to expand our e-commerce business, which is a key component to our all-channel strategy.”

Fellow retailers—Sobeys, LCBO, Giant Tiger, Jean Coutu, Browns Shoes, and the list goes on—are following suit and upgrading their facilities. They are being motivated by the ongoing advances in robotics technology, as well as a rising bar set by Amazon and Walmart, among other key competitors.

Economic imperatives

Economics is a driving force, says Alan Taliaferro, Partner at Deloitte in charge of the logistics and distribution practice in Canada.

“I’d say about five years ago the curves crossed between labour cost and the cost of equipment,” he says. “We could have put in robots in the ’80s but the cost was prohibitive given the labour rate at the time.

“But since the ’80s, labour has increased and the cost of the equipment is pretty much the same. It keeps getting miniaturized and made better, less steel goes into it because there’s more engineering in how it’s built, and other things like that. So, the equipment is actually becoming cheaper while labour is becoming more expensive.”

This development is having a profound impact on the way retailers see their business, Taliaferro says.

“What’s happening to the retail business is that it’s changing from an operating cost-based business—to a capital-based business, where a lot of capital is being invested into these things.”

He adds: “I think the industry structurally is changing. Now retailers need capital, so it’s more of a financial problem that can be solved through either borrowing or issuing stock, or whatever the financial strategy of the retailer is.”

“THIS IS NO LESS IMPACTFUL THAN THE MOVEMENT OF ROBOTS INTO THE AUTO INDUSTRY IN THE 1970S AND ’80S. IT WILL HAVE AS DRAMATIC AN EFFECT. THE COST SAVINGS ARE MASSIVE. AND IN A RETAIL MARKET WHERE RETAILERS FIND THAT TOP-LINE GROWTH IS ELUSIVE, THE BACKEND POTENTIAL FOR SAVINGS IS EXTRAORDINARY.”

DOUG STEPHENS

Retail Prophet

Changing mindset

“Ultimately, the retailer will be better off, but it’s a change in thinking,” he says. “I guess you could say there’s a wake-up call that all of a sudden we need to invest a lot more capital in our operations for all these reasons that everyone’s talking about—[rising] minimum wage, not enough skilled labour available, those types of things.

“We’re going to get the payback, so we’ve got to figure out how to find that capital and prioritize it to get that piece done.”

Stephens agrees that economic considerations are playing a major role.

“Some of this has to do with how you please your shareholders in a world where you’re not growing your top line and your stores look less productive each year, as is the case with some major chains, particularly in the U.S. but also in Canada,” he says.

“And so you have to look at backend costs, and when you’re using conventional warehousing methods there’s a minimum threshold in the number of people you can cut before that warehouse simply won’t work.”

The impact on HR

The robotics revolution carries big implications for human resources, too, Stephens says.

“When I talk to groups of retailers and we talk about technology, not just on the backend of the operation but also now creeping into the front end of the retail store, it seems almost inevitable that there’s going to be significant, widespread displacement of people here. So, I think companies would be well advised to start thinking about that now.

“How can we potentially retrain people? How can we redeploy them? Where could these people, who are loyal, hard-working brand ambassadors, be of the most value? Maybe a sizable proportion of those people can be redeployed.”

That comes with a caveat, however

“The old adage was that new technologies come along and create new jobs that we can’t now foresee,” Stephens says. “That was true in the Industrial Age where one machine might come in and replace three men or women. But we’re now talking about robotics and Artificial Intelligence in some cases, wiping out entire categories of work.”

He adds: “This isn’t just about the person walking bin to bin picking merchandise. This is potentially about the white collar manager whose responsibility is the overall warehouse operation. It’s going to have a significant toll on the industry, and I think we have to be prepared for that.”

A new kind of manager

Deloitte’s Taliaferro argues that “we need a different kind of manager” to step up to the challenge.

“It’s got to be somebody that’s technically capable of managing the operations of the machines and their various capacities, along with the operations of the humans that are feeding them or working alongside them. It’s a much more sophisticated manager of the future than a lot of the warehouse managers that are out there now.”

There are other considerations as well, Taliaferro says.

“I think it [robotics] is the way to go forward, but that doesn’t mean there are no drawbacks. If your business is highly volatile, if you a retailer in Chapter 11, I don’t think you would be able to go out and make a huge capital investment in this stuff unless you are pretty sure that your plan going forward was going to keep you in business.

“Because it’s a long-term investment that you’re making in these systems.”