Government Improves the CEWS Wage Subsidy Program Updated on October 9, 2020 and again on November 10, 2020

View RCC’s CEWS Overview for current and up-to-date information on the CEWS program.

UPDATE NOV 10, 2020

The CEWS program has been significantly adjusted to provide a subsidy for up to 65% of eligible wages until at least December 19, 2020 and potentially until June 2021 (it was to have dropped sharply on October 25, essentially losing half of its value for most claimants).

In essence, the government has frozen the support level at that of the previously announced Period 8 (i.e., September 27 to October 24, 2020), The CEWS base subsidy will remain at the current subsidy rate of 0.8x revenue reduction between 0% and 50%), measured either against the same month last year or against the average of January and February 2020. Hence the maximum assistance through the CEWS base subsidy is 40% of eligible wages.

As with the adjustment made this summer, you can use either the current month or the immediate past month as the basis to determine the assistance due for the current month.

Members will also recall that for those with YOY revenue reductions in excess of 50%, there is a top-up subsidy on eligible wages of 1.25x the revenue loss between 50% and 70%, which maxes out at a subsidy for 25% of eligible wages, bringing the maximum total subsidy to 65% (i.e., 40% base + 25% top-up).

For periods beginning September 27, 2020, applicants for the top-up subsidy can use the current month (or immediate prior month) YOY comparison in the same way as they do for the base CEWS subsidy. However, you can still opt to use the rolling three-month average YOY comparison if it would be advantageous to do so.

Hence, the CEWS top-up subsidy will now be calculated based on the better of (a) the same current month/previous month year-over-year comparison as exists for the base CEWS; or (b) the three-month revenue decline compared year-over-year.

The newly introduced CERS rent assistance program now mirrors the CEWS program in most respects, though unlike some of the design elements in CERS, CEWS does not have any additional caps on eligible expenses for a company or location.

The subsidy for furloughed employees will be capped at $573/week bringing it into line with the maximum amount available under EI/CRB.

Further detail on the CEWS program can be found at on the Government of Canada website.

RETAIL COUNCIL OF CANADA DETAILED ANALYSIS

Correction notice: This article originally referred to Period 7 as being from August 2 to August 29 under Phase 3 – the correct timeline for Period 7 is from August 30 to September 26. See table

RCC has been eagerly awaiting the new rules for the Canada Emergency Wage Subsidy (CEWS) since engaging in several discussions with the Finance Minister’s office, senior Finance tax policy officials and the Prime Minister’s Office at the end of May and beginning of June.

RCC’s ‘asks’ of government were that the second-generation program:

- Be extended to the end of 2020.

- Refocus on recovery, allowing for continued wage support even as revenues rise above 70% of prior comparator periods but still fall short of 100%.

- Provide support on a straight-line (i.e., smooth) proportional basis rather than in tranches.

- Address the particular issues of those who are on a slower recovery track, whether due to continuing public health orders or consumer behaviour (e.g., cinemas, sports, dine-in restaurants).

- Treat eCommerce revenues separately from bricks-and-mortar revenues (this request was made at a time when physical stores were still mostly closed by public order).

Although the government’s response has taken longer than anticipated, we are pleased to say that RCC’s first four ‘asks’ have been addressed in the new rules. Unfortunately, the government did not adopt our recommendation to exclude eCommerce revenues from retailers’ revenue decline calculations but given the sliding scale approach to CEWS and the top-up provision to partly address cumulative revenue reductions, that may be slightly less relevant.

While CEWS still requires the support of parliament to become law, the Bloc Quebecois has signalled support for the Liberal initiative, which would guarantee its passing in the House of Commons.

The program is a generous one, anticipated to cost $83.6 billion. It is also, however, a highly complicated one, which is unsurprising given the number of issues that it seeks to address. The following summary captures the essence of the new rules.

Phases of the CEWS program

There are now, effectively, four phases to CEWS, each composed of consecutive four-week Claim Periods:

Phase 1: The initial twelve-weeks between March 15 and June 6 that was subsequently extended by another four weeks from June 7 to July 4 (also known as Claim Periods 1, 2, 3 & 4);

Phase 2: The eight weeks between July 5 and August 29 (also known as Claim Periods 5 & 6). This phase, which we are currently in, allows for a choice around the method of measurement of revenue decline, in which companies will receive the better outcome between the old rules and the new rules;

Phase 3: The twelve weeks between August 30 and November 21 (also known as Claim Periods 7, 8 & 9). For this period, the new rules only apply; and

Phase 4: The last four weeks of the program (unless further extended) between November 22 and December 19 (also known as Claim Period 10), for which rules have not yet been released.

The wage subsidies discussed below continue to apply as a percentage of wages up to $1,129 per week to a maximum of $849/week in support per employee.

Revenue decline thresholds and corresponding subsidies

Phase 1

Phase 1 eligibility for 75% wage support required a decline of 15% from comparator period revenues for Claim Period 1 from March 15 – April 10 and a 30% decline in revenue during each of the three subsequent Claim Periods (2, 3 & 4) through to July 4.

The only exception to this was a deeming rule that said that if you qualify for CEWS in any one Claim Period, you do not have to prove revenue decline in the immediate subsequent Claim Period. In effect, this meant than any company that could qualify would automatically receive CEWS wage support for eight weeks but would then have to requalify for any later Claim Period. This rule is being adapted to be more flexible given the evolving support levels under the rules taking effect in Phase 2.

Phase 1, which ended on July 4, and provided a single level of wage support, i.e., 75%, is unaffected by the new rules, i.e., there is no re-visitation of decisions covering that phase.

Phase 2

Phase 2 introduces new rules that cover companies retroactive to July 5 and on through to August 29. The new rules provide for two levels of support. The first is a base subsidy of up to 60% for companies who have seen a revenue decline of any level in the Claim Period, with the subsidy proportional – on a straight-line basis – to the revenue reductions between 1% and 50%.

The way that the straight-line subsidy works is that during Phase 2, wage support percentages will be 1.2x the percentage of revenue decline experienced by the employer so, for example, companies that have seen a 10% revenue decline can get a wage subsidy of 12%, companies that have seen a 20% decline can get a wage subsidy of 24% and so on.

This base subsidy reaches its maximum 60% level at a revenue decline of 50%. This is a major change intended to provide some wage support as recovering businesses begin to approach prior revenue levels.

The new rules also introduce a top-up subsidy of up to 25% for companies that have seen cumulative revenue declines deeper than 50% during the Claim Period, for a maximum wage support level of 85%. See more on this top up subsidy further below.

If this were the sum total of the rules, it could be said to have created “winners” and “losers” because companies with revenue declines between 30% and 50% during the Claim Period would receive somewhere between 36% and 60% wage support rather than the 75% wage support they had received when eligible during Phase 1.

However, the government has adopted a “better of” principle for Phase 2, which they refer to as a “safe harbour”, whereby those who see a revenue decline of greater than 30% during the Claim Period will still get the 75% in each of Claim Periods 5 & 6.

So, what this has created is as follows for the two Claim Periods falling between July 5 and August 29:

- A sliding scale of support for those who have seen a revenue decline of between 1% and 30% during a Claim Period.

- A baseline guarantee of 75% wage support for those who have seen a revenue decline of between 30% and 50% during a Claim Period.

- An enhanced wage support level of up to 85% for those who have seen a revenue decline deeper than 50% during a Claim Period.

Note for New Brunswick: Phase 2 also sees the introduction of distinctive treatment between wages paid to active and furloughed employees, between whom there was no distinction in support during Phase 1, save that payroll contributions for EI, CPP, QPP and QPIP for furloughed employees were also recoverable by the employer. See more on that change below.

Phase 3

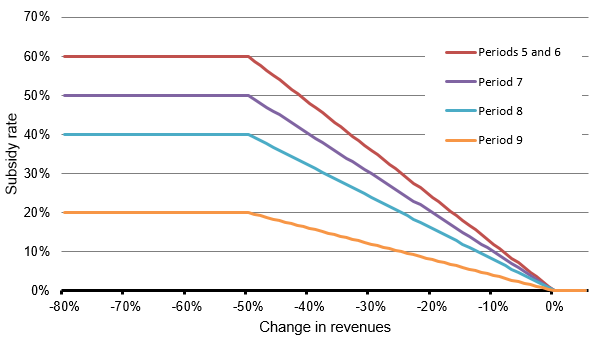

Phase 3 addresses the three Claim Periods between August and November 21 and begins the wind-down of the program by reducing the maximum support levels in successive months from 60% to 20%, as follows:

Maximum Base Subsidy (for companies with >50% revenue decline):

| Period 7 (Aug 30 – Sep 26) | Wage support of 50% | Maximum $565/employee/wk |

| Period 8 (Sep 27 – Oct 24) | Wage support of 40% | Maximum $452/employee/wk |

| Period 9 (Oct 25 – Nov 21) | Wage support of 20% | Maximum $226/employee/wk |

However, the 25% top-up remains to help those whose recovery is proceeding more slowly.

Proportional Base Subsidy (for companies with <50% revenue decline):

For companies with between 1% and 50% revenue decline, the multiplier of percentage revenue loss also begins to be reduced during Phase 3, as follows:

| Period 7 (Aug 30 – Sep 26) | Wage support of 1.0x percentage revenue decline |

| Period 8 (Sep 27 – Oct 24) | Wage support of 0.8x percentage revenue decline |

| Period 9 (Oct 25 – Nov 21) | Wage support of 0.4x percentage revenue decline |

Phase 3 ditches the “better of”/”safe-harbour” approach, so in Phase 3, companies are eligible only for the entitlement under the new rules and cannot fall back on a better outcome under the old ones.

Because the wage support levels are proportionate to revenue loss and are themselves being reduced month-over-month, it is not really possible to capture the outcomes in prose in any detail. The Department of Finance has provided a chart (“Figure 1”) and a far more useful table here:

Rate structure of the base CEWS, without the top-up

Rate structure of the base CEWS

| Timing | Period 5*: July 5 – August 1 | Period 6*: August 2 – August 29 | Period 7: August 30 – September 26 | Period 8: September 27 – October 24 | Period 9: October 25 – November 21 |

|---|---|---|---|---|---|

| Maximum weekly benefit per employee | Up to $677 | Up to $677 | Up to $565 | Up to $452 | Up to $226 |

| Revenue drop of 50% and over | 60% | 60% | 50% | 40% | 20% |

| Revenue drop of 0% to 49% | 1.2 x revenue drop (e.g., 1.2 x 20% revenue drop = 24% base CEWS rate) | 1.2 x revenue drop (e.g., 1.2 x 20% revenue drop = 24% base CEWS rate) | 1.0 x revenue drop (e.g., 1.0 x 20% revenue drop = 20% base CEWS rate) | 0.8 x revenue drop (e.g., 0.8 x 20% revenue drop = 16% base CEWS rate) | 0.4 x revenue drop (e.g., 0.4 x 20% revenue drop = 8% base CEWS rate) |

| * In Periods 5 and 6, employers who would have been better off in the CEWS design in Periods 1 to 4 would be eligible for a 75% wage subsidy if they have a revenue decline of 30% or more. As described further below (see Safe harbour rule for Periods 5 and 6). | |||||

Phase 4

There are no rules published (or yet determined) for this phase, falling between November 22 and December 19. It is unlikely to be any more generous than the immediate prior period, with the one proviso that a second wave of COVID-19 could lead to a re-visitation of the rules and program duration yet again.

Observations on the top-up subsidy

Unlike the base subsidy, which is calculated based on comparing monthly revenues to those in the same month in the previous year or to an average of January and February 2020 revenues, the top-up subsidy measures a longer period and speaks directly to an RCC “ask” to look at cumulative impact of the COVID-19 crisis.

Businesses have the option to choose between one of two methods:

Method #1

To determine its level of revenue decline, a company compares its cumulative revenues over the preceding three months to the same three months in 2019.

Method #2

Alternatively, a company can compare its average monthly revenues over the preceding three months to its average monthly revenues in January and February 2020.

The way that the top-up subsidy works is that additional wage support percentages will be 1.25x the percentage of revenue decline in excess of 50% experienced by the employer. For example, companies that have seen a 60% revenue decline can get a top-up subsidy of 12.5% for a total subsidy of 72.5% (i.e., 60% base subsidy + 12.5% top-up subsidy). However, during Phase 2, the “safe-harbour” provision would raise that subsidy to 75%.

Companies that have seen a 70% revenue decline can get a top-up subsidy of 25%, for a total subsidy of 85% (i.e., 60% base subsidy + 24% top-up subsidy), that being the maximum subsidy level in total.

Unlike the base subsidy, which is reduced over Periods 7, 8 and 9, the top up subsidy is not reduced and will remain constant until at least Period 10 (so until November 21).

Observations on furloughed employees

For Periods 5 and 6., i.e., until August 29, the support for furloughed employees will be at the same level as during periods 1-4. That support is for 75% of wages actually paid up to a maximum subsidy of $847/wk.

In order to avoid furloughed employees’ wages varying with their employers’ CEWS changing subsidy levels, the support will be adjusted in Periods 7-9 to reflect (which we read as be integrated with) CERB and/or EI benefits.

CEWS for furloughed employees will be available to any employer who qualifies for the base rate for active employees, i.e., has experienced a revenue decline.

Employer contributions for EI, CPP, QPP and QPIP on behalf of furloughed employees will continue to be recoverable by the employer.

In an important change and in order to make the return to work easier, as of July 5, CEWS will be also be available for employees that are without remuneration in respect of 14 or more consecutive days in an eligibility period.

Reference periods

In a similar vein to the two-month deeming rule that existed during Phase 1, an employer will have the option to choose the greater of the percentage revenue decline in the current period and that in the previous period for the purpose of determining its eligibility for base CEWS and its base CEWS rate in the current period.

This essentially means automatic qualification at the same revenue decline level for two periods in a row. It also means that you would get one last month of CEWS support even if your revenues show no decline in the current month as long as your previous month did have a revenue decline.

Those who happen to experience deeper relative revenue drops after July 5 would of course be free to use the revenue decline of the current month if that would deliver a better CEWS outcome.

Additionally, for Period 5 and onward, employers who chose to use a January and February 2020 monthly average for revenue decline calculations during Phase 1 will be able to choose to make a one-time switch to using the same month revenues in 2019 as the basis of their calculations – and vice versa. This decision would apply both to the base subsidy and to the top-up subsidy.

For further information, please contact: Karl Littler, Senior Vice President, Public Affairs at klittler@retailcouncil.org or 416-906-0040.

See also: