How mall foot traffic shifted post-pandemic and what it means for long-term success

May 24, 2023By: Michael Scida, Director of Retail Business Development at Environics Analytics

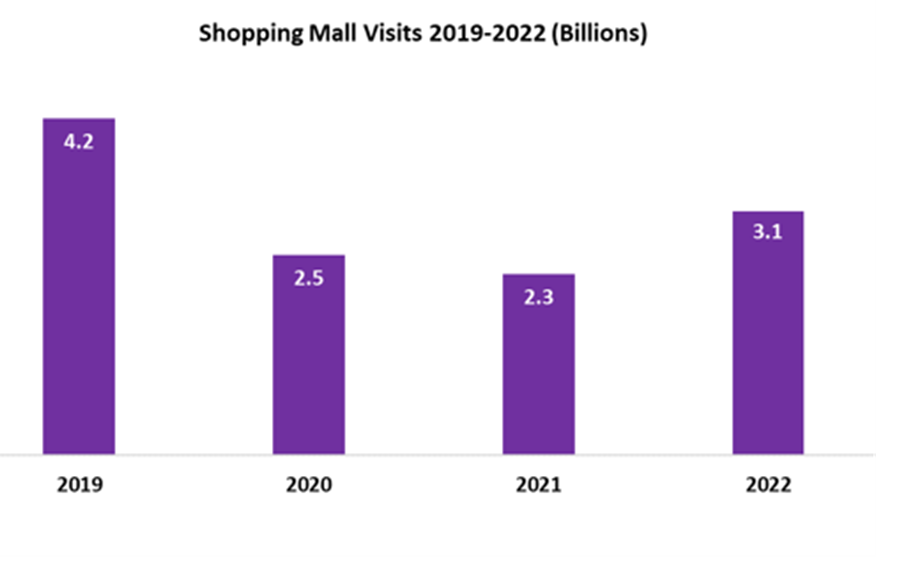

After two years of steady declines in mall foot traffic, we saw a resurgence in 2022 with 3.1B visits across Canada.

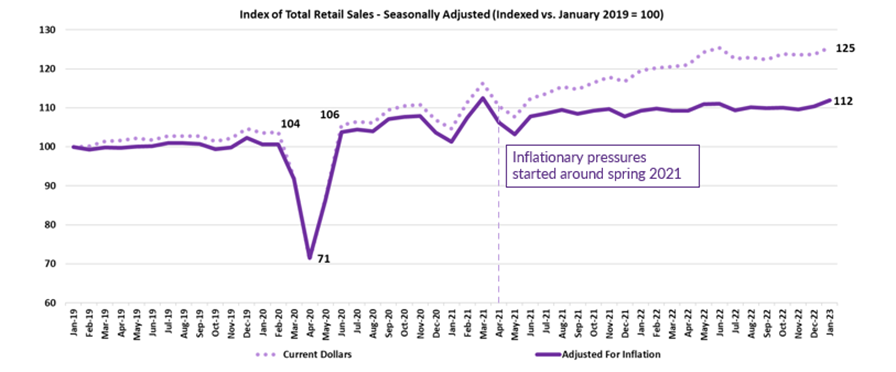

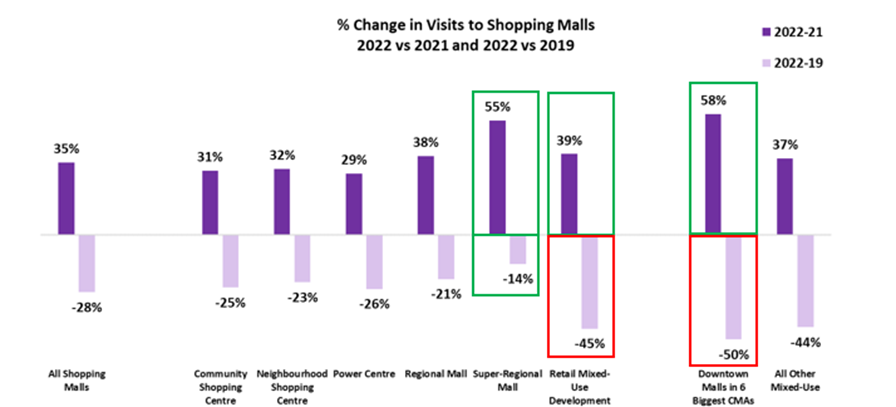

Despite foot traffic being up 35% from 2021, we are still down 28% from pre-pandemic (2019) levels. Even with the decreased foot traffic, we’re witnessing above-average retail sales increases of 12% (adjusted for inflation) since 2019.

This trend is leading to much more purposeful shopping trips from customers with increased spend per visit and higher basket counts.

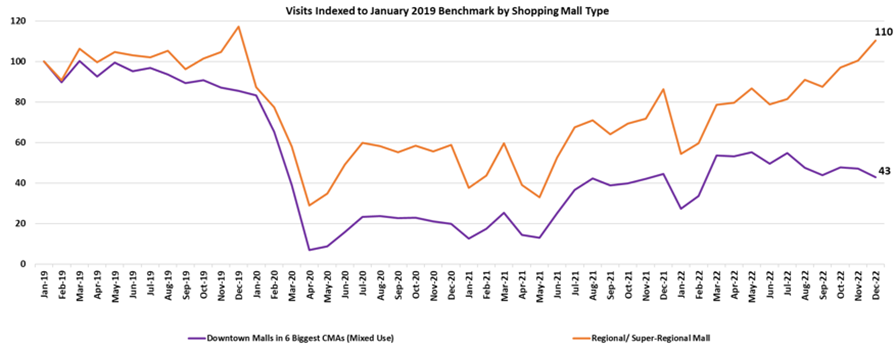

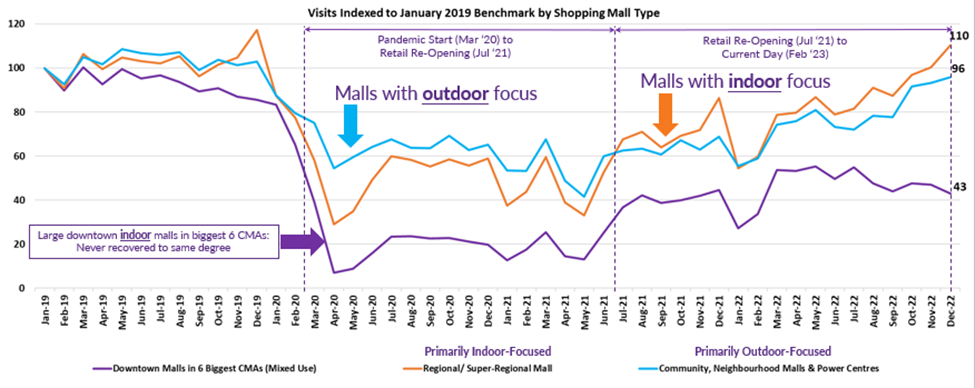

However, while some mall types have bounced back quite well, others are still far behind pre-pandemic levels. Mixed-use and downtown malls, despite having solid year-over-year increases, are still 50% down from pre-pandemic.

The worry for many downtown retailers and QSRs is that the changing geography of the workplace and hybrid work schedules may curtail further traffic level improvement at downtown properties.

However, it’s not all bad news; Super Regional malls grew the most out of any mall type with an increased visitation of 55% on the year and are now only 14% behind 2019 metrics. In fact, November and December of 2022 saw the highest foot traffic numbers in nearly three years, surpassing 2019.

When we look at mall format – indoor vs outdoor focused, we see an evident pattern of dominance following pandemic-related regulations. Outdoor-focused malls did better at the height of the pandemic, while indoor ones did better once indoor retail was fully back and re-opened in the summer of 2021.

However, indoor downtown malls did not recover compared to their indoor suburban counterparts due to unique conditions experienced downtown.

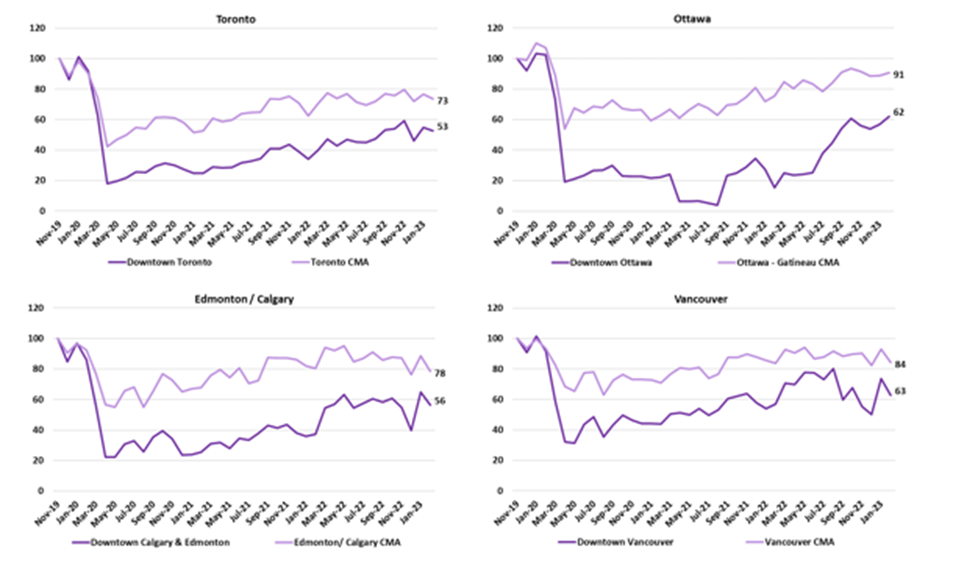

The trends are telling as we tie foot traffic trends with the return to work. Worker trends across Canada’s biggest cities and Downtown cores are recovering, albeit very slowly.

While most of Canada’s downtowns are currently operating at 50 to 65% capacity compared to 2019, the suburbs have fared much better. Suburb worker capacity ranges by region, but many are on par or slightly below what was seen pre-pandemic.

This has implications, especially for the largest downtown malls, which benefited greatly from the initial influx of workers who lived both downtown and farther afield who may now be working from home anywhere from 1-5 days a week. Downtown malls would have lost a complement of transient, impulse shoppers who, in the past, would have happened to be visiting as part of their everyday routine.

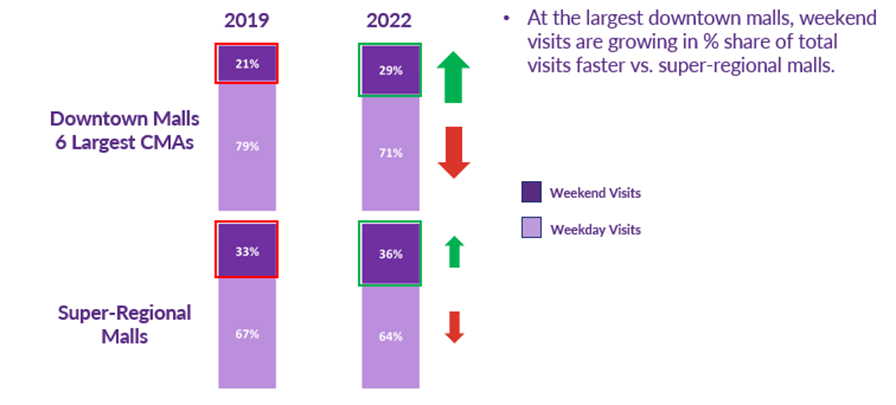

Looking at trends in daypart visitation, we start to see a proportional shift in traffic from weekdays to weekends. While there is less overall traffic at downtown malls, a higher proportion is now weekend versus weekday focused. The same trend is seen in the large suburban malls but is less pronounced.

Certainly, daypart visitation plays a considerable role in operationalizing your retail or QSR location, but a better understanding of the type of mall visitors can position your business for success moving forward. The nuances between a suburban visitor and an urban visitor can contrast greatly, as can their spending patterns when it comes to Restaurants or Clothing, for example.

While the recovery and challenge to bring downtown workers back into the office remain, there are some recent signs of optimism, with several big banks calling on their employees to return to the office in an effort to increase productivity. This will likely help the mixed-use centers and downtown malls in their bid to improve foot traffic and return to pre-pandemic visitation levels.