After CERB – what comes next? RCC’s guide to new income support programs

August 26, 2020

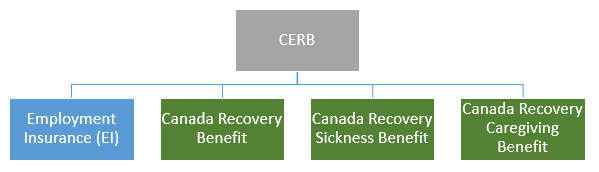

As the Canada Emergency Response Benefit (CERB) program draws to a close, it may be helpful to RCC members to understand the programs that replace it, whether through Employment Insurance (EI) or the three new income-support programs outside of EI. These programs are relevant as far as consumer demand goes, as there is significant evidence that CERB helped support retail sales over the COVID-19 period – and also as some commentators have been concerned about the impact of CERB on labour force availability.

When does CERB end?

CERB was extended twice, first from 16-weeks to 24-weeks in duration and most recently, for a further 4-weeks. So, for someone who has been on CERB since its inception, the last date covered is September 27, 2020.

Even for those who have not exhausted the 28 weeks by September 27 (if say, they were laid off later than March 15 or if they were recalled to work and then laid-off again), those people will also join the general exodus from CERB after September 27.

Four programs take over from CERB

- Employment Insurance (EI)

- Canada Recovery Benefit

- Canada Recovery Sickness Benefit

- Canada Recovery Caregiving Benefit

Read more about these programs in the Government of Canada Backgrounder

Employment Insurance changes

Anyone with 120-insurable hours during the last 52 weeks will automatically transition to EI benefits, with the duration of their benefits ranging from 26 weeks to 45 weeks depending on their number of insurable hours within the last 52 weeks and the region in which they live.

Payment will be a minimum of $500 or more per week before taxes.

The EI system will pay more than CERB for those who had been earning over $909/week while employed to a maximum of $573/week.

Income from employment (or self-employment) while on EI will be subject to a claw-back of $0.50 of every dollar earned. Unlike CERB, EI payments will be subject to income taxes at source.

Deemed 13.1% unemployment rate regionally

The duration of EI benefits varies by region because, as one would expect, it typically takes longer to find a new job in areas with high unemployment rates.

The government has deemed that all regions have an unemployment rate that is the greater of 13.1% and the actual unemployment rate in the region.

This ensures a minimum benefit length of 26 weeks (the minimum would otherwise have been 14 weeks) and allows for longer benefits in regions with unemployment rates above 13.1%.

EI contribution rates

Employers pay just over 58% of EI contribution rates and employees pay just under 41%.

Both Employer and employee rates are frozen at $2.21/$100 of insurable earnings and $1.58/$100 respectively until 2022.

Rates would otherwise have been expected to rise in 2021 but of course there will likely be rate hikes in 2022 and thereafter as the system has become more generous for the time being.

All of these changes can be effected without legislation, so prorogation of Parliament is not a factor.

Canada Recovery Benefit (CRB)

In addition, the government intends to legislate three new benefits, the first of which is the Canada Recovery Benefit. All three of these benefits are taxable, as is EI and as was CERB. Unlike CERB, all three payments will be subject to income taxes at source.

All three are funded from the Government’s Consolidated Revenue fund rather than from the EI Account.

The CRB benefit will pay $500/week for up to 26 weeks. Qualifying individuals must be looking for work and either have stopped working or had their incomes reduced due to COVID-19. CRB recipients will be required to repay $0.50 of every dollar earned above an annual net income of $38,000 through their income tax return.

The system is based, much as CERB was on an attestation and requires bi-weekly filing.

Canada Recovery Sickness Benefit (CRSB)

The CRSB is intended for employees who do not have or have already exhausted paid sick leave through their employer.

The benefit will enable employees to stay home from work when they are sick or required to self-isolate due to COVID-19.

The CRSB pays $500 per week for up to two weeks.

Canada Recovery Caregiving Benefit (CRCB)

The CRBC is for individuals who have to stay home in a caregiving capacity. There are two main bases for qualification:

- staying home to care for a child under the age of 12, a family member with a disability, or a dependent because schools, daycares, or other relevant care facilities are closed due to the pandemic,

- staying home to care for a family member because a medical professional has deemed that person to be at high-risk of severe illness if they were to contract COVID-19.

The CRBC pays $500 per week per household for up to 26 weeks. This distinguishes it from CERB, under which more than one recipient in a household could claim CERB as a caregiver.

The CRBC benefit can only be claimed when facilities are actually closed and not because people “prefer” to keep their children or other dependents at home.

For further information, please contact Karl Littler, Senior Vice President, Public Affairs at klittler@retailcouncil.org or 416-906-0040.

Related Resources:

- Relief Measures by Region

- COVID-19 Recovery Toolkit

- Job Connect: Find retail jobs.