NOTICE: This page regarding COVID-19 information and protocols may be out of date. RCC members looking for clarification regarding this resource are asked to email membership@retailcouncil.org.

As retail businesses begin to reopen across the country, this page will help you stay informed on rules and regulations in your area.

Resources from the Government of Canada

Advice for essential retailers during the COVID-19 pandemic

The Government of Canada provides a comprehensive guide on maintaining public health guidelines within stores and businesses.

Risk mitigation tool for workplaces/businesses

The Government of Canada provides a guide on minimizing the risk of spreading COVID-19 among reopening.

Canadian Centre for Occupational Health & Safety

The CCOHS provides different COVID-19 response and mitigation resources, including tip sheets, best practices for reopening, in store signage, and more.

Best practices for the prevention of COVID-19 in the workplace

This document gathers practical advice about COVID-19 prevention in the workplace. The information was taken from Canadian public health agencies as well as from practices observed in essential businesses that have remained in operation at the peak of the crisis.

Reopening resources for retailers

RCC’s Store Capacity Calculator

Check your facility’s capacity with this interactive calculator.

Sign and poster resources also available.

Google COVID-19 Community Mobility Reports

These Community Mobility Reports chart movement trends over time by geography, across different categories of places including retail and recreation, groceries and pharmacies, parks, transit stations, workplaces, and residential.

Resources, tips, and best practices on transmission reduction

ICSC’s COVID Resources for Small Businesses

- Reopening and recovery resources from government services

- Aggregated list of resources to provide best practices for reopening efforts

CDC’s Resuming Business Toolkit

- Readiness checklist

- Worker protection tools

- Returning to work infographics and other resources

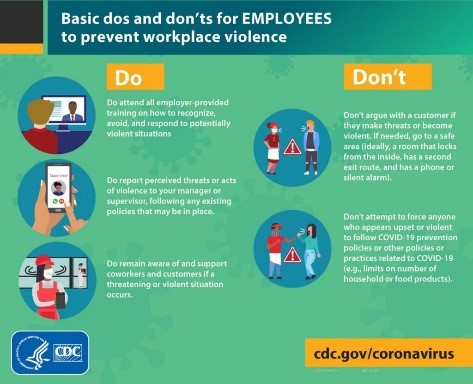

CDC guidance on how to deal with ‘anti-mask’ customers

Retailers and their employees who are dealing with customers who refuse to wear masks can now refer to the new Centers for Disease Control and Prevention (CDC) guide.

Reopening resources by Province

Relevant and updated COVID-19 reopening resources and best practices, province by province.

Les exigences en matière de vaccination varient selon la province ou le territoire. Pour en savoir plus, veuillez consulter la page du site du CCCD consacrée aux exigences provinciales en matière de preuve vaccinale.

Our dedicated COVID-19 page is updated daily with information

addressing retailer-specific questions and concerns.

RCC webinars are also open to all retailers every Wednesday on a variety of topics that impact retail operations during the COVID-19 crisis. RCC’s dedicated team are also available for members to contact with specific questions about the most current regulations in their areas.

If you have questions specific to your area, please contact RCC’s Regional Directors directly:

- Pacific: Greg Wilson, gwilson@retailcouncil.org, 604-730-5254

- Prairies: John Graham, jgraham@retailcouncil.org, 204-926-8624

- Ontario: Sebastian Prins, sprins@retailcouncil.org, 416-467-3759

- Quebec: Michel Rochette, mrochette@cccd-rcc.org, (514) 792-4430

- Atlantic: Jim Cormier, jcormier@retailcouncil.org, 902-818-7738

- Public Affairs: Karl Littler, klittler@retailcouncil.org, 416-906-0040

- Media: Michelle Wasylyshen, mwasylyshen@retailcouncil.org

- President & CEO: Diane J. Brisebois, djbrisebois@retailcouncil.org, 416-801-3793

The CERS was a federal rent and property expense support program established to help businesses affected by COVID-19. If eligible, retailers would have received direct support from the federal government. The CERS program ended on October 23, 2021, but retroactive application remains available.

Applications to the Local Lockdown Program will be administered by the Canada Revenue Agency (CRA) on a period-by-period basis.

Retailers will need to apply through the CRA via MyBusiness Account (MyBA) OR Represent a Client. View CRA Local Lockdown Program page.

Adding any extra features would not necessarily change the requirements. A retailer would still need to ensure the product is clearly labelled, that it is not intended for medical use and does not pose a danger to human health or safety.

There are no regulations specific to a fashion face covering or mask. However, it’s important to know that masks are assumed to be medical devices unless it is explicitly clear on the labelling that they are not intended for medical use. Additionally, the same regulations that would apply to any product being sold in Canada are still applicable. View Regulatory requirements for non-medical masks/fashion face coverings more info.

A retailer would not require an MDEL to sell to the public. However, if they sell masks to a hospital or health care facility, they would be considered a medical device distributor and would require an MDEL.

- The health care provider who makes the diagnosis has the obligation to call and inform Public Health right away.

- The Public Health official will conduct the investigation and contact the employer, notifying them about the investigation.

- Any disclosure to other employees must respect privacy legislation and be done in accordance with advice from the public health unit.

- Specific requirements vary by jurisdiction. At a minimum, restrict access to area(s) the employee worked and comprehensively disinfect the premises using a Health Canada-approved disinfectant.

- Continue to practice physical distancing, regular handwashing and other regularly prescribed COVID-19 mitigation protocols

- Generally, an employer is not obligated to inform customers. Public Health officials will conduct an investigation and provide the required follow-up.

RCC has an incident checklist for retailers dealing with a positive COVID-19 case. View checklist.

There is little consistency amongst jurisdictions on this question. See “Returns” in RCC’s COVID-19 Requirements for Retailers guide.

The occupancy rules vary by province. Generally, they are based on either the number of people per square metre, or, percentage of the fire code occupancy limit. See “Maximum number of people in store” in RCC’s COVID-19 Requirements for Retailers guide.

Comprehensive information how businesses and employees can stay safe while operating during COVID-19 from the Public Health Agency of Canada is here.

Phishing, videoconferencing vulnerabilities, malware and simple mistakes are only some of the increased cybersecurity risks.

Retailers seeking to protect themselves against heightened fraud and cybersecurity risk must look to their people (e.g. training), processes (e.g. Bring Your Own Device (BYOD) policies) and technologies (e.g. updated virus protection, videoconferencing safety).

Keep in mind that not all fraud risks are necessarily cyber risks. For example, reported COVID-19 scams include fraudsters posing as public health agencies to get personal information (retailers should always check that someone asking them for this data has legal authority to do so) and posing as vendors selling COVID-19 tests.

Read more:

- View more information and links to Canadian COVID-19 fraud and cybersecurity guidance.

- View federal Privacy Commissioner videoconferencing tips.

Cybersecurity guidance specifically for small and medium businesses exists and could be useful to many independent retailers. View resources.

This program, despite its name, has sector-agnostic application criteria. In other words, the sector you are in is irrelevant to the loan application.

Criteria are mainly financial and include your ability to demonstrate the pandemic’s significant negative financial impact on your business. View RCC HASCAP Overview.

The HASCAP Guarantee is a federal government support program to help the businesses hardest-hit by COVID-19. This program was available to all eligible retailers, regardless of sector, up until March 31, 2022.

Retailers can apply through their primary financial institutions for a HASCAP loan of $25,000 – $1M to cover their operational expenses. The government (BDC) will provide a 100% net loss guarantee to make it easier for these retailers to secure a loan.

To qualify, a retailer must, among other criteria:

- be a commercial enterprise whose intent is to generate revenue from the sale of goods or services that is at least sufficient to cover its operating expenses and service its debt

- have been financially stable and viable prior to the current economic environment

- not have an impaired loan (as determined in accordance with International Financial Reporting Standards) as at March 1, 2020, or the eligible loan closing date

Applicants must also have received payments from one of the federal Covid-19 financial relief programs. If your business did not qualify for any of the federal support programs, but otherwise meets all HASCAP eligibility criteria, you can provide financial statements that show three months in which monthly year-over-year revenue decreased by at least 50% within the eight-month period prior to the date of the HASCAP Guarantee application.

Phishing, videoconferencing vulnerabilities, malware and simple mistakes are only some of the increased cybersecurity risks.

Retailers seeking to protect themselves against heightened fraud and cybersecurity risk must look to their people (e.g. training), processes (e.g. Bring Your Own Device (BYOD) policies) and technologies (e.g. updated virus protection, videoconferencing safety).

Keep in mind that not all fraud risks are necessarily cyber risks. For example, reported COVID-19 scams include fraudsters posing as public health agencies to get personal information (retailers should always check that someone asking them for this data has legal authority to do so) and posing as vendors selling COVID-19 tests.

Read more:

- View more information and links to Canadian COVID-19 fraud and cybersecurity guidance.

- View federal Privacy Commissioner videoconferencing tips.

Cybersecurity guidance specifically for small and medium businesses exists and could be useful to many independent retailers. View resources.

The Canada Recovery Benefit (CRB) was a program that helped individuals affected by Covid-19. The CRB ended on October 23, 2021.

Shortly before the Omicron surge, the government announced a new CRB-like $300/week benefit called the Canada Worker Lockdown Benefit (CWLB). Eligibility for the CWLB only arises in the event of a local lockdown public health order.

L’indemnité de confinement est une aide supplémentaire offerte dans le cadre du programme de soutien fédéral de la Subvention d’urgence du Canada pour le loyer (SUCL), destinée aux détaillants obligés de composer avec des directives sanitaires liées à la COVID-19. Établi comme une subvention pour le loyer octroyée aux détaillants durement touchés par la COVID-19, la SUCL a pris fin le 23 octobre 2021.

Il demeure toutefois possible de présenter des demandes rétroactives. Si vous avez dû fermer ou cesser vos activités pendant une semaine ou plus dans un ou plusieurs de vos établissements en raison d’une directive de la Santé publique, vous êtes peut-être admissible à l’indemnité de confinement, laquelle peut représenter jusqu’à 25 % des dépenses admissibles (par commerce touché) suivant le nombre de jours où la directive a été en vigueur.

Les détaillants doivent garder à l’esprit que, s’ils ne sont pas admissibles à la SUCL de base au cours d’une période donnée, ils ne peuvent pas non plus présenter de demande d’indemnité de confinement pour cette période.

L’aperçu de la SUCL du CCCD contient de plus amples informations.

If the stores have separate ownership, e.g. if they have different business numbers, then they have to submit separate applications. If they all fall under one business number, then one application can be submitted, with each of the Work-Sharing units documenting on a separate Attachment A.

For more detail, RCC

SOPs on workplace safety can be found here.

- Most jurisdictions require worker screening for symptoms prior to entry into the workplace. Workers who fail screening should not enter the store or office, and should put on a mask before going home.

- Employees and customers who are ill must be informed (signage) not to enter the store.

- Many jurisdictions require employees and customers to wear masks in indoor public spaces. See RCC’s Mask Requirement page.

- Break rooms, lockers and employee gathering places such as offices are proven to be places where the virus is most often spread in workplaces. Where possible, schedule breaks and lunch hours at staggered times to reduce interactions. Ensure physical distancing in break rooms, change rooms, outdoor smoking areas, and offices.

- Where employees must carpool to and from work together, try to start and end their shifts at the same time to reduce their interaction with other employees.

- Enhance the workplace sanitation plan and schedule, and ensure staff are practicing proper hygiene. This includes frequent hand washing, coughing or sneezing into an elbow rather than a hand, and avoiding touching one’s face.

- Ensure the washrooms are always well stocked with liquid soap and paper towels and that warm running water is available. Antibacterial soap is not recommended to prevent the spread of COVID-19.

- Provide clean carry-out bags for purchased products while respecting provincial and local laws. You may choose to enact a policy that customer packaging (reusable bags, containers, cups or boxes) will not be handled by workers.

- Use a physical queue line controls such as markers or cordons at entrances and in checkout lines inside stores.

- Where applicable, place markers every 2 metres at checkouts and entrances to provide customers with visible cues that support physical distancing.

- Place alcohol-based hand sanitizer dispensers near doors, payment stations and other high-touch locations for customer and staff use, making wipes and trash bins available for wiping shopping carts and disposing of the wipes.

- Have clear signs at each entrance that indicate the maximum number of customers and staff a store can accommodate at any one time.

- Monitor the number of customers and staff entering and leaving the store. Once the maximum number of persons for a store is reached, allow one person in for every person that leaves.

- Offer online or telephone orders with delivery or pick-up services as alternatives to shopping in person.

- Clean high touch surfaces such as pay stations, bagging areas and carts or hand baskets between each customer and use and encourage tap payment over pin pad use.

- Limit the handling of credit cards and loyalty cards wherever possible, by allowing customers to scan.

- Employees who handle cash or credit card must wash their hands frequently with soap and water. This includes before any breaks, at the end of their shift, and before preparing food.

- Should operators and employees choose to use gloves, employees must wash their hands thoroughly before putting on the gloves and change them regularly. Change the gloves before you handle money or credit card machines, and afterward. Wearing gloves does not reduce the need for hand washing. Even while wearing gloves, employees must avoid touching the face.

- The health care provider who makes the diagnosis has the obligation to call and inform Public Health right away.

- The Public Health official will conduct the investigation and contact the employer, notifying them about the investigation.

- Any disclosure to other employees must respect privacy legislation and be done in accordance with advice from the public health unit.

- Specific requirements vary by jurisdiction. At a minimum, restrict access to area(s) the employee worked and comprehensively disinfect the premises using a Health Canada-approved disinfectant.

- Continue to practice physical distancing, regular handwashing and other regularly prescribed COVID-19 mitigation protocols

- Generally, an employer is not obligated to inform customers. Public Health officials will conduct an investigation and provide the required follow-up.

RCC has an incident checklist for retailers dealing with a positive COVID-19 case. View checklist.

Vaccination requirements vary across Canada. For more information, see RCC’s Table on Proof of Vaccination Requirements by Province.

The CRA has a list of requirements that you must meet at the end of the tax year in order to be a Canadian-controlled private corporation (CCPC).

The general theme is that the CCPC label is restricted to private companies controlled by Canadian individual and private corporate residents.

The main wage subsidies still available to eligible retailers are the Canada Recovery Hiring Subsidy (CRHP) and wage support under the Hardest-Hit Business Recovery Program (HHBRP) and Local Lockdown Support (LLP).

Wage subsidies under the Canada Emergency Wage Subsidy (CEWS) also remain available for eligible retailers, via retroactive application, for a few months leading up to the CEWS’ program’s last day on October 23, 2021.

View RCC’s CEWS overview. View CRHP Overview. View HHBRP Overview. View LLP Overview.

The time periods for which retailers may qualify for CEWS subsidy coverage end on October 23, 2021. Retroactive applications remain open.

During the Omicron surge the government announced that the repayment deadline for CEBA loans to qualify for partial loan forgiveness had been extended from December 31, 2022, to December 31, 2023, for all eligible borrowers in good standing.

Repayment on or before the new deadline of December 31, 2023, will result in loan forgiveness of up $20,000. Any outstanding loans will subsequently convert to two-year term loans with interest of 5 per cent per annum commencing on January 1, 2024, with the loans fully due by December 31, 2025.

No. The program is closed and is no longer receiving applications. The deadline to repay the CEBA loan and qualify for partial loan forgiveness has been extended until December 31, 2023. View government website.