State of the Canadian mall

March 6, 2019

Investing in today’s shopping centre

CANADA’S shopping centres continue to see gains in overall productivity, outperforming those in the U.S. And with this success, landlords are investing heavily to create compelling gathering places, and adding ‘experiences’ to create multi-use community centres.

Retail Council of Canada’s 2018 Canadian Shopping Centre Study looks at Canada’s top malls in terms of annual sales per square foot as well as annual visitor count. And it’s the first edition of the study that has compared sales numbers from the year prior. The study also discusses what makes some of the top centres successful, providing details of what landlords have planned over the next few years.

Year over year gains

Remarkably, almost all of the top 30 most productive shopping centres saw gains in 2018 when compared to the year prior. Toronto’s Yorkdale Shopping Centre was the top centre again in 2018 with annual sales per square foot of $1,905, up more than 15 per cent from 2017. Yorkdale is on track to surpass annual sales per square foot of $2,000 and could see overall revenue surpass a whopping $2-billion in 2019.

Canada’s malls continue to, overall, outperform those in the United States. In addition, Canadian malls have seen year-over-year gains since 2010, while U.S. centres have seen moderate declines since 2015. The United States has considerably more retail space per capita when compared to Canada, and it would appear that Canadians are embracing physical retail at a time when more consumers are increasingly shopping online.

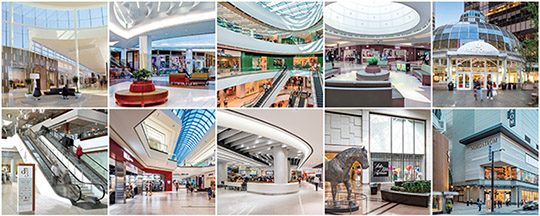

Attractive interiors, a mix of popular retailers and food options, amenities such as upgraded washrooms and other elements of ‘retailtainment’ are common among Canada’s leading shopping centres.

Canada’s larger metropolitan regions continue to dominate the top-30 productivity list and unsurprisingly, the Greater Toronto Area dominates the list with 11 such centres. The Greater Vancouver Region, however, has the most per capita with seven centres in the top 30 for sales per square foot.

Furthermore, 12 Canadian shopping centres saw annual sales per square foot exceed $1,000 in 2018. That’s up from eight centres in the study the year prior. Of the 12 malls reaching the $1,000 productivity milestone, all were in major metropolitan regions (Toronto, Vancouver, Ottawa, Calgary and Edmonton). In 2018, for the first time, a mall outside of these regions surpassed $1,000 per square foot—the honour goes to the Conestoga Centre in Waterloo, Ontario, which broke the barrier, ranked number 11 of all centres in Canada in terms of productivity.

When you go downtown

One interesting phenomenon is the strength of Canada’s downtown shopping centres when compared to those in the U.S. Of the top 30 most productive malls in terms of sales per square foot, three are in downtown cores—that includes the CF Toronto Eaton Centre in Toronto, CF Pacific Centre in Vancouver and CF Rideau Centre in Ottawa. Furthermore, four of the top ten busiest malls in terms of annual visitors are in Canadian downtowns—CF Toronto Eaton Centre, Montreal Eaton Centre, CF Pacific Centre and CF Rideau centre all scored highly. In the U.S., none of the country’s leading shopping centres are in downtown cores outside of New York City.

Strength on strength

In Canada, the best malls have all seen recent investments to make them even better. Landlords are competing for customers and have been upgrading their properties with renovations and expansions, while at the same time adding new retailers and attractions to get shoppers to visit their malls rather than a competitor, or online sites.

Attractive interiors, a mix of popular retailers and food options, amenities such as upgraded washrooms and other elements of ‘retailtainment’ are common among Canada’s leading shopping centres. And accessibility is key, be it having enough parking spaces for guests or convenient public transit options.

Consumers continue to seek out experiences, and the best centres offer what you can’t get online. To enhance the experience, landlords are adding more restaurants as well as upgraded food and beverage options. Toronto’s Yorkdale Shopping Centre, for example, added Canada’s first Cheesecake Factory restaurant in 2017, and it’s still busy. Landlords are taking it one step further as they add food halls and food markets to their centres. Oxford Properties is leading the way by adding food halls to its malls—Upper Canada Mall’s 40,000 square foot ‘Market & Co.’ opened in the fall of 2018, and the centre saw an immediate spike in visitors as a result. Even the mall’s food court saw increased sales. More will open in 2019 and beyond, with landlords Cadillac Fairview, Ivanhoé Cambridge and QuadReal also planning on adding similar experiential food options as they devote more space in their malls for food.

Landlords are beginning to innovate in other ways, too. Entertainment concepts such as The Rec Room are opening in shopping centres in Canada.

And this fall, Cirque du Soleil will open its first mall-based entertainment concept at Vaughan Mills in suburban Toronto. Even non-traditional uses such as co-working and flexible workplace concepts are opening in malls—LAUFT opened at Upper Canada Mall in Newmarket, Ontario, in late 2018, with a goal to attract visitors seeking temporary work spaces who might also spend money at the centre’s retailers and food vendors.

Why Yorkdale is so productive

Claire Santamaria, General Manager of the Yorkdale Shopping Centre in Toronto, provided her opinion on what makes Yorkdale Canada’s top-producing mall. “We work hard to attract retail that is experiential and is not available elsewhere,” she said, with a goal of bringing customers more frequently to the mall. Having a mix of ‘great’ retailers is also important—Yorkdale asks retailers to “put their best foot forward” with flagship stores in the mall according to Santamaria, which has resulted in some of the largest and most productive stores for many major chains.

“Listening to the customer” is also important, says Santamaria, describing how landlord Oxford Properties seeks out brands that shoppers ask for, including sought-after brands that Yorkdale can introduce to the marketplace. Some of these are major luxury brands looking to get a foothold in the Canadian market. And Santamaria explained how Oxford Properties educates these brands on their success potential at Yorkdale through partnerships and marketing and on the benefits of being in the mall, which include proven sales numbers as well as flexibility to create spaces that often isn’t the case on urban street fronts with multiple landlords. Their efforts are paying off. Yorkdale has seen more international brands open their first stores in Canada than any other centre in the country.

The continued success of Canadian shopping centres suggests that landlords will continue to invest in their properties in 2019 and beyond. It’s a race to the top as they look to secure the most popular brands while at the same time create engaging, entertaining environments that will continue to attract shoppers.

CANADA’S CENTRES OF PRODUCTIVITY

+$1,000

12 Canadian shopping centres saw annual sales per square foot exceed $1,000 in 2018, up from 8 in 2017.$1,905

Annual sales per square foot at Toronto’s Yorkdale Shopping Centre in 2018, Canada’s most productive centre, up more than 15% from 2017.+1/3

There are 11 centres located in the Greater Toronto Area on the top-30 productivity list, more than any other metropolitan area. The Greater Vancouver Region, however, has the most per capita with seven centres in the top 30.3

Of the top 30 most productive malls, three are in downtown cores—CF Toronto Eaton Centre, CF Pacific Centre in Vancouver and CF Rideau Centre in Ottawa.53.7 million

Source: Retail Council of Canada’s Canadian Shopping Centre Study 2018

The CF Toronto Eaton Centre is, by far, the busiest shopping centre in North America in terms of annual visitor count. In 2018, the downtown centre saw an incredible 53.7 million visitors.

One of the next big trends will be the intensification of shopping centre sites with residential towers, offices and hotels—most landlords are owned by institutional investors seeking strong returns on investment, and mixed use developments can create considerable profit. Vancouver’s Oakridge Centre is an example as it is redeveloped into a truly spectacular mixed-use community that will include retail (some high-end) as well as thousands of residential units, a massive community centre, public library, performance facility, dance academy, a park, and other nonretail uses. In decades to come, some Canadian shopping centres could end up acting more like city centres than mere retail malls, creating an experience that cannot be replicated online.

BY CRAIG PATTERSON